Smarter Claimant Earnings Reporting with the Earnings Calculator

“Do the math.” Simple advice—until you’re a claimant trying to calculate weekly earnings while juggling hours, wages, tips, and commissions. Small mistakes are common, but in unemployment insurance (UI) programs, they carry big consequences: improper payments, delays, and headaches for claimants and agencies alike.

That’s why NASWA Behavioral Insights (BI), in partnership with one of our vendors, designed an Earnings Calculator intervention.* Built for states through the UI Integrity Center, the tool uses behavioral science to make reporting earnings easier—and more accurate.

Why Claimants Struggle

Claimants don’t always make errors because they’re careless. Behavioral science shows us that confusion and stress get in the way:

- Many individuals experience cognitive load as they balance internal and external pressures from their personal lives with the complexities of navigating UI rules.

- Under stress, people tend to satisfice, offering a “good enough” estimate instead of calculating precisely.

- Certain forms of income, such as tips or commissions, lack salience and are easy to forget.

- Ordering effects — how and when earnings questions are presented in the certification flow — can create confusion, leading claimants to provide incomplete or inaccurate responses.

These are not necessarily failures of effort; they are predictable outcomes of a system that can rely too heavily on claimants doing their own math.

A Smarter Approach

The Earnings Calculator was designed to remove that burden. A calculator embedded within the online continued claims system eliminates claimant math errors that could otherwise lead to mismatches with employer data.

How it Works

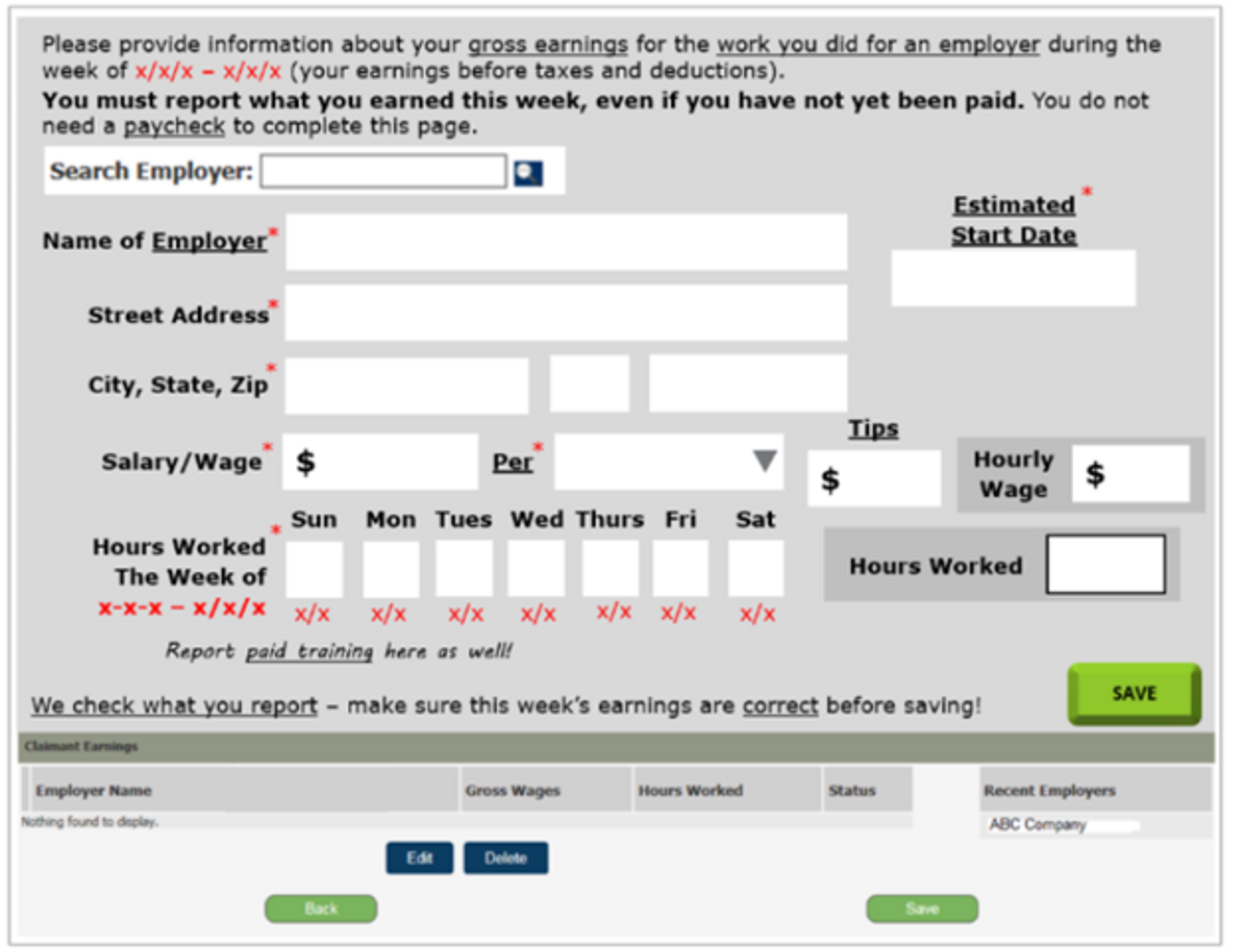

Claimants who report part-time earnings are redirected to the Calculator page, where they enter hours worked, hourly wage, and additional income like tips or commissions.

Because the tool also includes fields for each type of employer-provided earnings, claimants see all the categories they should be considering, making it much harder to leave something out. The system then computes the total and pre-populates the earnings field automatically. The calculator makes accuracy the default. Claimants don’t have to wrestle with calculations; the system does it for them.

NASWA recommends that states build the calculator directly into the continued claims process, if possible, to appear at the right time in the claim. If a system cannot integrate the calculator into the claim, providing a simpler linked version of the calculator or alternative formats can still help reduce reporting errors.

When the Calculator page appears automatically after claimants respond they have earnings to report, it is using choice architecture to guide behavior. Claimants can’t move forward without completing the required fields. Instead of relying on memory or rough guesses, they’re prompted to enter the relevant information step-by-step, lowering the chance of error before submission.

Why It Matters for States

Earnings reporting errors cause overpayments for claimants and add costs for agencies. Implementing an embedded calculator helps states achieve:

- More accurate self-reported earnings, reducing mismatches with employer data.

- Fewer improper payments, improving overall program integrity.

- Reduced claimant stress and confusion, lowering call center demand and appeals.

When systems do the math for claimants, everyone benefits: fewer errors, stronger integrity, and a smoother experience for the people we serve and the staff who serve them.

Connect with NASWA BI

The calculator is ready for your state to use! Some states have already implemented it, making adjustments to better fit into their UI processes. We can help you assess feasibility, adapt the calculator to your needs, and implement it to reach your integrity goals. Reach out to us at integrity@naswa.org to learn more.

*The linked documents above require a Library login to access them. Watch this video for help.